EC 250 Macroeconomic Analysis

Course Takeaways

- What is the economy (i.e. output production. aka GDP)?

- goods and services created that can we can place monetary value on

- some activities may not be included like people staying at home instead of paying for daycare

- output is made up by capital stock, labour and a productivity factor, which doesn’t have numerical breakdown

- there are many ways to measure GDP

- goods and services created that can we can place monetary value on

- Without impacting consumption, only productivity determines long-run economic growth

- there are a variety of ways to improve productivity, read the section on policies long-run-growth policies

- Capital

- Capital are assets that people use to generate output

- Investments are made to maintain and grow capital

- Labour

- People choose to make trade-offs between leisure and money

- People want to fund their leisure time so work money for that purpose

- Obviously and unfortunately, there are situations where the person is living to work versus working to live

- Economic Cycle of busts and booms (“full employment”)

- “full employment” is where unemployment rate equals natural unemployment, something hard to measure and can change

- natural unemployment can exist due to matching issues (e.g. oil & gas jobs went to renewable sector) and due to the friction of changing jobs (hunting for a job after being laid off)

- Policies can be created to reduce matching issues and Employment Insurance can affect the friction (noticeable between provinces).

- shocks are what change the state of the economy drastically

- technology shocks (transistor, internet), productivity shocks (COVID-19), supply shocks (higher oil prices because of OPEC)

- Money

- exists for the sole purpose of making commerce efficient

- money can be interpreted as liquid assets meeting “what can be used to buy goods right now”

- money supply is influenced by the central bank and is made large because of fractional reserve lending

- for each dollar deposited at an institution, if the bank knows it only requires 20% to meet demand, it can lend until 80% has been fully lended (divide by 0.81)

- Inflation: increase in the price of goods and services

- can be deliberately induced by the central bank

- central bank policies have a lagging effect so money supply can grow in the past year and its effects may take another year

- goal of money supply growth is to reduce interest rates to spur investments

- money supply has no effects on full-employment in the long-term, short-term is up for debate since it does cause inflation

- if the money supply grows, market participants end up realizing their dollars are worth less in a real sense and will increase prices

- currently most central banks focus on annual inflation, but if they focused on stable price levels, then it would make it easier to properly invest today’s money. Inflation targeting results in $1 being equal to a range of values in 20 years rather than a single value, which would be the case if price level targeting was used instead.

- inducement by federal

- crowding out: interest rates go up (lower private investments) because federal government spending too much

- costs of inflation

- cost of updating price labels: shoe leather costs

- unanticipated inflation hurts savers and rewards banks and lenders

- hyperinflation: money loses meaning

- unexpected inflation and unemployment are related

- almost impossible to keep inflation unexpected

- can be deliberately induced by the central bank

Chapter 1 Introduction

Long-Run Economic Growth

- Developed countries have experienced extended periods of rapid economic growth whereas developing have either never experienced it or had periods of economic decline

- long-term growth: increase in output per unit of labour input (per worker, per hour) (aka average labour productivity)

- how to increase?

- 2016 Canadians 6x output than 1921 Canadians

Business Cycles

- short periods of slower and negative growth or rapid growth

Unemployment and Price Instability

- two key economic variables for measuring economic costs

- inflation: ongoing increase in prices of goods and services

- 1970s (10%)

- deflation: ongoing decrease in prices of goods and services

- Great depression (wages also fell)

- Policy makers guard against the threat of prolonged periods of deflation such as Japan has experienced since the 1990s (BUT WHY)

- Also don’t want to be like Zimbabwe with runaway inflation (hyperinflation)

International Economy

- open economy

- significant trading and financial relationships with other national economies

- closed economy: does not interact with rest of the world

- trading

- export: allows Canadian manufacturers to grow larger than if they were limited to the Canadian market

- import: allows Canadian consumers to choose from the best the world has to offer

- think: import fruits during Winter and export excess wheat

- When Exports > Imports, trade surplus.

- Trade deficit is when Exports < Imports.

- Exchange rate influences the trade balance

Macroeconomic Policy

- Fiscal

- Federal, Provincial, Municipal levels

- Spending

- Taxes

- Monetary

- Central bank

- Interest rate

Aggregation

- Aggregate consumption is the total consumer spending

- Not interested in finer details

- Interested in aggregate economic measures which is the sum of each variable

Macroeconomic Forecasting

- Forecasting is a small part

- long-term forecasting is too difficult as there are too many variables

- OPEC oil price

- Droughts

- Focus on interpretation of events as they occur (analysis)

- Focus on structure of the economy (research)

Macro Economic Analysis

-

Monitor the economy and figure out implications of current events

-

Private sector (impact on financial investments)

-

Public sector

- assist in policy making

- macroeconomic problems

- identifying and evaluating possible policy options

-

Actors: households, firms, and government

-

Change in income, interest rates, wealth influence on consumption

-

Motivations to increase/decrease taxes

-

Central bank responding to inflation

Economic Model Experiments

Evaluation of an economic model

- Are its assumptions reasonable and realistic?

- Is it understandable and manageable enough to be used in studying real problems?

- Does it have implications that can be tested by empirical analysis? That is, can its implications be evaluated by comparing them with data obtained in the real world?

- When the implications and the data are compared, are the implications of the theory consistent with the data?

Comparative Static Experiments

- Initial in equilibrium (demand = supply in all markets)

- A single independent variable is changed

- Events can be shocks (weather that affects wheat yields, discovery of new oil)

Disagreeing Macroeconomists

- always can find someone who disagrees with the status quo

- can even disagree with themselves

- positive analysis: economic consequences without desirability analysis

- what would happen if income tax increased by 5%

- normative analysis: whether a policy should be used

- should income tax be increased by 5%

Classicals vs Keynesians

- Adam Smith’s Invisible hand

- with free markets, individuals will do their own economic affairs for their interests resulting in the overall economy will working well

- Suggested wages and prices adjust fast

- issues; droughts, war, political instability

- developed vs developing

- argued that free markets makes people as economically well off as possible

- key assumptions: no minimum wage or interest rate ceilings

- classicists would argue for limited government role

- Keynesian

- Offered an explanation for the great depression’s high unemployment

- Suggested wages and prices adjust slowly

- Government should take actions to alleviate unemployment resulting in slow adjustment of wages and prices

- proposed solution: increase government purchases of goods and services

- demand for what resources?

- proposition was that to handle the demand, more people would need to be hired and then multiplier effect does the rest

- with what money?

Chapter 2 - The Measurement and Structure of the Canadian Economy

- measurement is possible and is required for serious understanding

National Income Accounting

The measurement of production, income, expenditure.

- national income accounts are an accounting framework used in measuring the current economic activity

- product approach: measure in terms of output produced (sold) excluding intermediate

- sum of value-added (output price - input costs)

- income approach: incomes received by the producers of output

- tax revenue, wages, after-tax profits (shareholder income?)

- expenditure approach: spending by the purchasers of output for consumption and not for input

- add up end user purchases

- total production = total income = total expenditure (fundamental identity of national income accounting)

Gross Domestic Product (GDP)

- broadest measure of aggregate economic activity

Product Approach

- Value-added = Output Sold - Intermediate Output + Inventory Increase

- some useful goods and services are not sold in formal markets

- homemaking, child rearing (and child breeding 😭) done by parents

- action to reduce pollution or otherwise improve environmental quality are not usually reflected in the GDP

- underground economy

- activity hidden from government

- illegal activity such as drug dealing, prostitution, etc.

- government services

- proposed to count at the cost to provide the service

- for housing markets, only new house sales are counted, realtor service is always counted though

- trucking/shipping is intermediary so isn’t counted…

- goods that are not used up, such as a lathe, are capital goods that are classified as final goods and included in GDP

- inventory increases are considered final goods because of “greater productive capacity”

- Gross National Product (GNP): domestic factors of production

- Canadian capital and labour used abroad

- net factor payments from abroad (NFP) is income paid to domestic factors of production by the domestic economy (GDP + NFP = GNP)

- GNP is crucial in countries where remittance is sent home (citizens working abroad)

Expenditure Approach

- income-expenditure identity

- Y = C + I + G + NX

- Y= GDP = total production = total income = total expenditure

- C =consumption

- domestic households on final goods and services (60%)

- durable goods (furniture, cars, appliances)

- semi-durable goods (clothing)

- non-durable goods (food and utility)

- services

- I = investment (25%)

- new capital capitals: fixed capital investment

- inventory investment

- government does make investments so that would go here

- G = government purchase of goods and services (20%)

- interest payments are not considered (good)

- is spending fueled by increase in debt counted? yes

- NX = net exports of goods and services

- Exports are spending done by foreigners (injection)

- Imports are spending done abroad

Income Approach

- Employee compensation

- Gross operating surplus (paid to owners of incorporated companies)

- do not include interest costs

- Gross mixed income (unincorporated enterprises)

- Taxes less subsidies on production (net taxes paid by corporations regarding production)

- Taxes less subsidies on products and imports (net taxes paid regarding the final output)

- statistical discrepancy

- expenditure approach minus income approach (added to income)

Private Disposable Income

- want to know how much income goes to private sector (households and businesses) so that demand for consumer goods can be predicted

- private disposable income = Y + NFP + TR + INT - T

- NFP = net factor payments from abroad

- TR = transfers received from the government

- INT = interest payments on the government’s debt

- T = taxes

- net government income = T - TR - INT

- GNP = Y + NFP

Saving and Wealth

- assets household owns minus what it owes = wealth

- national wealth is an important metric

- rate of saving

- national wealth depends on how much individuals, businesses, and governments save

Aggregate Saving

- Private saving = private disposable income - consumption = (Y + NFP + TR + INT - T) - C

- Private saving rate = Private Saving / Private Disposable income

- Government saving = net government income - government purchases = (T - TR - INT) - G

- budget surplus = T - (G + TR + INT)

- National Saving = private saving + government saving = Y + NFP - C - G

- Private saving is used for capital investment, financing for government, acquire assets from or lend to foreigners

- S = I + (NX + NFP) = I + CA

- Current Account Balance (CA) = NX + NFP

- payments received from abroad - payments sent abroad

- NFP is negative in Canada meaning foreigners earn more from ownership of Canadian factors of production than Canadians receive due to their ownership of foreign factors of production

- Private Saving = I - Government Deficit + CA

uses-of-saving identity. Private savings are used in three ways

- investment

- government budget deficit

- current account balance

Saving to Wealth

- Flow variables: measure per unit of time (e.g. annual GDP)

- Stock variables: one point in time (e.g. amount of money in your bank account on December 20th)

- flow is equal to the rate of change of the stock

- National Wealth = domestic physical assets + net foreign assets

- net foreign assets: foreign stocks, bonds, and factories owned by domestic residents minus foreign liabilities (domestic assets owned by foreigners)

- National wealth can change due to the values changing, or national saving dollar for dollar

- Therefore, national saving can be used to increase stock of domestic physical capital (I) and increase foreign assets

Nominal vs Real

- Nominal refers to current market values

- Does not work for different points in time since market values can increase due to inflation

- Real GDP, constant dollar GDP, measures GDP using prices of a base year

- Nominal GDP, current dollar GDP

- To convert, multiple outputs of GDP by price per output of the base year

Price Indexes

- Average level of prices for some specified set of goods and services

- GDP deflator: price index that measures overall level of G&S in GDP.

- real GDP = nominal GDP / GDP deflator

- Consumer Price Index

- Prices of consumer goods (basket)

- Concern is that the base year might get outdated due to changing consumer habits and goods available

- Inflation = (CPI_n / CPI_(n-1)) - 1

- Since 1989, inflation target for Canada is between 1 and 3% per year

- Can be overstated due to:

- quality/technology improvements

- substitutes

Interest Rates

- Rate of return promised by the borrower to a lender

- The nominal interest rate is the rate at which the nominal (or dollar) value of an asset increases over time.

- The real interest rate is the rate at which the purchasing power of an asset increases over time

- Varies according to who is borrowing, length, and other factors

- Real vs Nominal Rates

- real interest rate = nominal interest rate - inflation rate

- the nominal rate doesn’t account for that the nominal dollars might not buy more assets than the year before

- Expected real interest rate

- borrowers and lender act based on this

- r = i - expected inflation rate

- Expected inflation

- Difficult to determine expected rate

- Ask public

- Assume public has same expectations as what the government announces or private forecasts

- Extrapolate based on current inflation rates

Lesson 1 Summary

- Identify the major issues studied in macroeconomics.

- Explain what macroeconomists do.

- Highlight the similarities and differences between Classical and Keynesian macroeconomists.

- Discuss the three approaches to measuring national income.

- Identify key macroeconomic variables related to national income and discuss how they are related.

- Explain the meaning of these important macroeconomic statistics:

- Gross Domestic Product,

- Consumer Price Index,

- the inflation rate,

- the interest rate.

- Calculate the macroeconomic statistics (listed above).

- Discuss the distinction between real and nominal GDP.

- Calculate the GDP deflator.

- Explain the difference between real and nominal interest rates.

- Calculate the expected real rate of interest.

Chapter 3 - Productivity, Output, and Employment

- Labour market

- Goods and services market

- Asset market

- Full employment

- QS = QD

- Long-term behaviour

- Economic productive capacity

- The more an economy can produce, the more consumption, and the more saving and investing

- Quantities of input and productivity of the inputs

The Production Function

- If an economies factories, farms, and other businesses all shut down, other economic factors would not mean much

- Capital (factories, machines) and labour (workers, would autonomous AGI robots count?)

- Y = A F(K, N)

- Y = real output produced in the current period

- A = overall productivity (total factor productivity)

- K = capital stock, quantity of capital

- N = number of workers employed in the current period

- F = Function relating Y to capital K and N

- Cobb-Douglas production function: Y = A K^a N^(1-a)

- Under certain conditions, a corresponds to the share of income received by capital and labour gets 1 - a

Productivity and standard of living is highly correlated, but is it a casual relationship? I don’t think so. There has to be a common cause of both these two variables (obviously one being the income in the previous year, but I’d argue we need to look at monthly data since a year is simply the Earth traveling around the Sun but nothing really economical).

Canada Productivity

A = Y / (K^0.3 N ^0.7)

Statistics Canada: The Production Function of Canada 1981-2015

| Year | Real GDP Y (Billions of 2012 dollars) | Capital, K (Billions of 2012 dollars) | Labour, N (Millions of workers) | Total Factor Productivity A* | Growth in Total Factor Productivity (% change in A) |

|---|---|---|---|---|---|

| 1981 | 857 | 1019 | 11.3 | 19.66 | N/A |

| 1982 | 830 | 1048 | 10.9 | 19.30 | –1.8 |

| 1983 | 852 | 1063 | 11.0 | 19.63 | 1.7 |

| 1984 | 904 | 1078 | 11.3 | 20.37 | 3.8 |

| 1985 | 951 | 1100 | 11.7 | 20.86 | 2.4 |

| 1986 | 977 | 1116 | 12.0 | 20.89 | 0.2 |

| 1987 | 1022 | 1134 | 12.3 | 21.35 | 2.2 |

| 1988 | 1066 | 1165 | 12.7 | 21.61 | 1.2 |

| 1989 | 1091 | 1198 | 13.0 | 21.62 | 0.0 |

| 1990 | 1092 | 1225 | 13.1 | 21.37 | –1.1 |

| 1991 | 1070 | 1247 | 12.9 | 21.10 | –1.3 |

| 1992 | 1080 | 1253 | 12.7 | 21.40 | 1.5 |

| 1993 | 1106 | 1258 | 12.8 | 21.83 | 2.0 |

| 1994 | 1160 | 1273 | 13.1 | 22.48 | 3.0 |

| 1995 | 1190 | 1288 | 13.3 | 22.70 | 1.0 |

| 1996 | 1209 | 1303 | 13.4 | 22.83 | 0.6 |

| 1997 | 1264 | 1332 | 13.7 | 23.37 | 2.3 |

| 1998 | 1313 | 1362 | 14.0 | 23.70 | 1.4 |

| 1999 | 1386 | 1392 | 14.4 | 24.42 | 3.0 |

| 2000 | 1461 | 1424 | 14.8 | 25.14 | 3.0 |

| 2001 | 1483 | 1459 | 14.9 | 25.12 | –0.1 |

| 2002 | 1526 | 1483 | 15.3 | 25.31 | 0.7 |

| 2003 | 1555 | 1512 | 15.7 | 25.20 | –0.4 |

| 2004 | 1602 | 1553 | 15.9 | 25.47 | 1.1 |

| 2005 | 1654 | 1611 | 16.1 | 25.77 | 1.2 |

| 2006 | 1694 | 1678 | 16.4 | 25.77 | 0.0 |

| 2007 | 1732 | 1743 | 16.8 | 25.64 | –0.5 |

| 2008 | 1749 | 1810 | 17.0 | 25.36 | –1.1 |

| 2009 | 1694 | 1833 | 16.7 | 24.75 | –2.4 |

| 2010 | 1744 | 1887 | 17.0 | 25.01 | 1.0 |

| 2011 | 1798 | 1952 | 17.2 | 25.26 | 1.0 |

| 2012 | 1827 | 2024 | 17.4 | 25.17 | –0.4 |

| 2013 | 1871 | 2093 | 17.7 | 25.26 | 0.4 |

| 2014 | 1926 | 2165 | 17.8 | 25.63 | 1.4 |

| 2015 | 1938 | 2202 | 17.9 | 25.51 | –0.4 |

| 2016 | 1954 | 2212 | 18.1 | 25.56 | 0.2 |

| 2017 | 2022 | 2234 | 18.4 | 26.02 | 1.8 |

| 2018 | 2067 | 2258 | 18.7 | 26.28 | 1.0 |

- Marginal Product of Capital (MPK) is the additional units of output for every unit of capital. (delta Y / delta K)

- diminishing marginal productivity: MPK decreases as capital stock increases

- call centre where there is one telephone per cubicle vs there already being 5 per cubicle

- Marginal Product of Labour (MPN) is the additional units of output for every unit of labour. (delta Y / delta N)

- Supply/productivity shocks: a change in the production function

- changes in weather

- innovations or inventions in management techniques

- mini-computers, statistical analysis in quality control

- government regulations

- anti-pollution laws

- Ease and efficiency to access financial capital for facilitating day-to-day operations

Demand for Labour

- Since capital stock is long lived and investments only have a significant effect slowly, it is often fixed by economists when analyzing a few years

- year-to-year changes can often be traced to changes in employment

- assumptions

- workers are all alike (ignore aptitude, skills, ambition, etc. ) (why though? I feel that ambition & skills are very important, such as minimum wage jobs and non-minimum wage jobs)

- firms decide how many to employ, not at what wage to employ, that’s determined by competition

- firms hire based on maximizing profit (true but some company’s are hiring for growth and then doing mass layoffs)

- the benefit of the extra worker exceeds their cost

- when the marginal product of labour (MPN) equals the real wage (in units of output)

- Marginal Revenue Product of Labour (MRPN), measure extra revenue produced for adding another worker = Price times MPN

- MRPN = MPN * price = nominal wage

- We can also state that the real wage is determined by the output, so then we can state when MPN increases, increased employment / real wage increase

- the real wage is cost to employ (nominal wage) divided by selling price per unit

- The labour demand curve is relationship of the workers demanded and the real wage the firm faces (equal to MPN curve)

- N doesn’t have to be workers per se, could be hours

- It shifts due to supply shocks. Positive shocks increases MPN (and thus employment).

- Reducing payroll taxes would be a supply shock

- Reducing sales tax is not a supply shock. That’s a goods demanded shock

- Generally, an increase in capital stock also increases MPN

- Aggregate Labour Demand

- demand for labour of all firms in the economy

- Labour hoarding

- During a recession, hiring and firing costs are too much to otherwise layoff

Supply of Labour

- Each person decides whether to work or to do non-work actions (leisure)

- We want to give as many people possible the right to not work and not get paid

- A person who wants to make themselves as well off as possible, would work as much such that each hour worked makes up for each hour of free time given up

- Therefore, real wage = amount of real income that a worker receives in exchange for giving up a unit of leisure

- Substitution effect of a higher real wage: workers supply more labour in response to a higher reward

- Pure income effect

- when a worker’s wealth increases, the income is less valuable, therefore more time is spent on leisure

- when future wages will increase, there is an implied increase in wealth, therefore more time is spent on leisure

- long-term increase in real wage: both effects

- temporary no income effect since workers want to take advantage

- permanent we see income effect (aggregate supply of labour goes down)

- size of effect is dependent on each person’s situation include tax rates

- Suppose tax percent has increased just for the current year

- less likely to work since the time spent working is definitely less than letting go off leisure and since it’s only one year, the loss of income for one year isn’t convincing enough

- suppose there is a lump-sum tax (value not percentage)

- income effect only, so have to work more

- Labour Supply Curve

- quantity of labour supplied for the real wage

- shifts right if economy-wide real-wage rises

- Increase in wealth increases amount of leisure workers can afford (curve shifts left)

- Increases in expected future real wages increases amount of leisure workers can afford

- Increase in working age population increases number of workers (curve shifts right)

- An increase in the participation rate increases number of workers

- Equilibrium

- Classical model implies quick real wage adjustments

- Assumption is that people would be able to find jobs very quickly

- At equilibrium workers get a wage that just about equals the compensation for surrendering leisure

- When neither side is satisfied, something will have to give to get to Equilibrium

- When many workers are competing for few jobs, real wage falls

- full-employment level (N with line on top) at market-clearing real wage (w with line on top)

- have no accounted for unemployment yet

- A negative supply shock would decrease demand for labour (which equals MPN) at every level of employment so we could get lower wages

- there is a decrease in demand for labour because the expenditure for non-labour factors are higher and thus there is a lower optimal level

- Temporary, so labour supply curve does not shift

- Classical model implies quick real wage adjustments

Since more firms in Canada use petroleum as an input in the production process than produce oil as an output, increases in energy prices have generally been viewed as an adverse supply shock for the Canadian economy as a whole. Canadian firms have become more energy efficient due to these shocks.

Labour Market Equilibrium

- People earning under 40,000 (2011 dollars) have been the same since the 1980s, but the middle class is becoming richer

- Explanation is that there is unskilled labour and skilled labour, with the latter being the reason for the difference in wage increases

- Skilled-biased technological change occurs

- Full Employment Output (Y with line on top) = A F(K, N (with line on top))

- Education levels do not affect the labour market since the students are not part of the workforce and thus MPN has not actually increased (yet?)

- Things like energy supplies are other factors of production that can definitely impact the labour market (higher costs means higher MPN required)

- Immigration does increase output at full-employment, but of course real wages decrease due to the labour supply curve shifting right

- When skilled immigration increases, the real wages of skilled workers falls

- When unskilled immigration increases, the real wages of unskilled workers falls

Example 1

- Y = 9 K^0.5 N^0.5

- MPN = 4.5 K^0.5 / N^0.5 [derivative of above]

- NS = 110 * ((1 - t)w)^2

- K = 25

- Suppose t = 0 or t = 0.3. What is the equilibrium real wage and the level of employment?

- At full-employment, MPN = real wage.

Solution

1. w = 4.5 * 5 / (110 * ((1 - 0)w)^2) ^0.5

w = 22.5 / (110w^2)^0.5

w = 22.5 / 110^0.5 w

w^2 = 22.5 / 110^0.5

w = (22.5 / 110^0.5) ^0.5

w = 1.4647

N = 235.98

2. w = 4.5 * 5 / (110 * ((1 - 0.3)w)^2) ^0.5

w = 22.5 / (110 * 0.7^2 w^2) ^0.5

w = 22.5 / (110 * 0.7^2)^0.5 w

w = (22.5 / (110 * 0.7^2)^0.5)^0.5

w = 1.75

N = 165.1

Example 2

- MPN = 400 - 4N

- NS = 18 + 10w + 2T (where T = lump-tax of 38)

- What is the equilibrium real wage and the level of employment?

Solution

Assuming MPN = w,

N = 18 + 10 (400 - 4N) + 2*38

N = 18 + 4000 - 40N + 76

41N = 4094

N = 99.85

w = 400 - 4 * 99.85

w = 0.60

3.5 Unemployment

- Not everyone who would like to work can find a job

- 54,000 households are surveyed every month

-

- Employed (worked full-time or part-time the past week or was on leave/strike)

-

- Unemployed (person was without work during the past week, sought a job in the past four weeks, and was available for work)

-

- Not in labour force (did not work and did not look for a job in the past four weeks)

- Employment-ratio is employed / working-age population

- Participation rate is the labour force / working-age population

- Discouraged workers: people who stop searching due to lack of success

- Unemployment spell: period of time an individual is continuously unemployed and the length of time is called duration

- Out of the unemployed, most have long durations, but most people who become unemployed have short-durations (low amount of workers with high churn compared to amount of workers with low churn)

- Reasons for unemployment

- Frictional: searching for suitable jobs

- Structural: chronic unemployment

- low-skilled workers are often unable to obtain desirable or long-term jobs

- could be because of inadequate education

- reallocation of labour from shrinking to growing industries

- low-skilled workers are often unable to obtain desirable or long-term jobs

- Natural rate of unemployment is the prevailing unemployment rate when output & employment is at full-employment levels

- Cyclical unemployment is the difference between the actual and natural unemployment rate (u vs u with overbar)

- My guess is that Canada’s natural rate of unemployment is between 5.5% - 5.6% because it was around this in 2019 and was below this during the inflation that occurred during 2022. When rates started going up, so did unemployment and now we are at 5.8% which I believe is still above natural unemployment due to the higher numbers of international students and the hours they can work.

Lesson 2 Summary

- Explain how output is determined using the production function.

- Sketch the relationship between output and capital (holding labour constant) and output and labour (holding capital constant).

- Discuss and calculate the marginal productivity of capital and labour.

- Analyze the impact of positive and negative supply shocks on the production function and output.

- Discuss the determinants of labour demand and supply.

- Discuss equilibrium in the classical model of the labour market.

- Discuss the categories of employment.

- Calculate key labour force variables.

- Discuss the different types of unemployment.

Chapter 4 - Consumption, Saving, and Investment

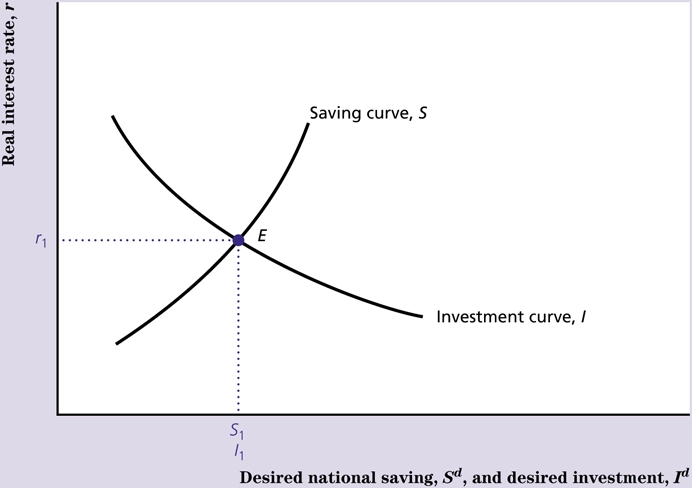

- Goods market equilibrium is when desired savings = desired investment

- Income (after-tax) = Saving + Consumption

- Desired consumption Cd

- Desired national saving, Sd occurs when Cd is met (in a closed economy)

- Sd = Y - Cd - G

Individual Consumption Decisions

- $20,000 income after taxes

- Could spend all of it or save some of it

- The future expectation may influence spending decisions today

- Could borrow to spend more this year, but the cost is bourne in the future

- Real interest rate r affects the trade-off

- Desire to have relatively even spending pattern over time is known as consumption-smoothing motive

def f(income_1=35_000, income_2=30_000, tuition=6150, i=0.05, wealth=0):

desired_consumption = (wealth * (i + 1) + income_1 * (i + 1) + income_2 - tuition) / (2+i)

print(f'desired consumption = {desired_consumption:.0f}, desired saving = {(income_1 - desired_consumption):.0f}')

return desired_consumption, income_1 - desired_consumption

Current Income and Consumption

- Suppose $3,000 bonus after taxes

- Marginal propensity to consume (MPC)

- Fraction of additional current income that would be consumed in the current period

- When income reduces, it gives the fraction of current income lost that is saved

- If MPC is 0.4, and income lowered bt $4,000, consumption would reduce by $1,600

Expected Future Income and Consumption

- If income is expected to start coming in, consumption will be higher than if no employment opportunity was upcoming

Wealth and Consumption

- Similar the current income expect that expenditures clearly come out of savings and not out of the additional current income

- Because people own a part of their wealth in equities, the performance of the stock market ought to influence consumption spending

- Another major form of wealth is housing

- Therefore, one could argue, inflation could be cooled by decimating the housing market. If people who bought houses for investments get wrecked, they will spend more and thus prices will cool

- “5.7 cents for every dollar increase in housing wealth, but not measurable for increases in stock market wealth” - Lise Pichette, “Are Wealth Effects Important for Canada?,” Bank of Canada Review, Spring 2004.

- one third of households own stocks, two thirds own a house

- stock prices are more volatile

- primary household capital gains tax exemption

- concerns of a housing bubble that may one day burst may impact the whole economy ($4,000 less spending per house)

Real Interest Rate and Consumption

- higher interest rate is two pronged

- one hand: take advantage of higher payoff

- substitution effect of the real interest rate on saving (save more and spend more in the future)

- other hand: need smaller amounts to achieve target

- income effect of the real interest rate on saving

- need to consider people are borrowers as well

- borrowers can consume less when they have to spend more on interest

- the effect on real interest rates and national saving is not very strong but a higher national savings is said to lower real interest rate

Comments

- cars don't last as long as houses and require financing (interests) - houses are 10x car prices and have amortization period of 20+ years so higher interest rates means paying more in interest + you need to pay maintenance - some people are - interest payments on student loans (not applicable anymore due to federal laws allowing tax deduction) - the situation where real interest rates rise seems like during periods of high inflation → less inflation so maybe people had to reduce consumption and the temporary higher real interest rates just allows for returning to normal spending habits - when real interest rates rise, what are expectations for the stock market? If they are the same, then why would people save more? how many people are actually saving? - https://www.thestar.com/business/majority-of-canadians-now-have-more-debt-than-savings-statcan-says-here-s-why-the/article_40e0159e-b6fc-11ee-aaed-839d0983b705.htmlTaxes and Interest Rates

if i is the nominal interest rate and t is the income tax rate,

(1 - i)t is the after-tax nominal rate

Expected after-tax real interest rate

pie is the expected inflation rate.

Target overnight rate is the key indicator of monetary policy. The overnight rate itself is what chartered banks make on short-term loans to one another. Where is the repo market and who has access to it?

- Reserve ratio:

- how much banks must keep as reserves which prevents the banks from loaning out

- the central bank pays interest on the reserves (interest on reserves) for banks to deposit into the central bank

- Discount rate: how much it costs to loan money from the central bank

- Open Market operations: central bank can purchase or sell government treasuries which is an opportunity cost for banks when they lend to each other

- This is basically subsidizing by the central bank

Fiscal Policy

- The assumption is that fiscal policy does not affect aggregate supply of goods and services and that aggregate output Y is given

- This assumption is everything wrong with the economy. It’s why we are where we are and not in the future already

- If governments derived policies that targeted aggregate supply of goods and services in a way that creates jobs and not in a way that competes with other businesses for the G&S it bid for, Canada would be more innovative. How is green technology going to give us all jobs?

- The textbook says this assumption is valid at full-employment (people who are chronically unemployed can be hired though) and that the policy won’t significantly affect capital stock or labour supply

- Affects Cd which is that $1 less in consuming is $1 more in national saving

- Government spending can come from higher taxes which means less consuming

- If governments have to borrow, that means taxpayers have to pay more taxes in the future…expected future incomes will fall, thus reduced consumption

- Any temporary increase in government spending will reduce desired national saving because the new amount saved will always be less than the amount G spent

- With tax cuts thrown in, “anything goes”

- Consumers are not going to be thinking about future tax increases, so either government spending goes down the same amount as tax cuts or desired consumer spending will increase and national saving will decrease. If government spending went down an equal amount, then there would be higher national saving because of course not all the income that was kept would be spent.

- Ricardian equivalence proposition: that tax cuts or increases do not affect consumption

Investment

- increase capacity to produce and earn profits in the future

- fluctuates sharply over the business cycle and can account for half or more of declines

- goes down because of expected future profits / demand. Will government spending increase prices or actually lead to the intended chain effect of increased investment

- seems like during recessions, governments should be investing heavily to get better equity in startups/innovation rather than give grants

- important in understanding long-run productive capacity

Determinants of Desired National Saving

| An Increase in… | Desired National Savings… | Reason |

|---|---|---|

| Current output | Rise | Part of the extra income is saved to provide for future consumption. |

| Expected future income | Fall | Anticipation of future income raises current desired consumption, lowering current desired saving. |

| Wealth | Fall | Some of the extra wealth is consumed, which reduces saving for given income. |

| Expected real interest rate, r | Probably rise | An increased return makes saving more attractive, probably outweighing the fact that less must be saved to reach a specific savings target |

Desired Capital Stock

- Amount of capital that would allow the firm to earn the largest expected profit

- MPKf is the expected future marginal product of capital which is the benefit from one unit of investment today

- Example

- $1,000 oven per cubic metre

- no operational costs (solar-powered)

- 10% depreciation (10% less efficient every year)

- borrowing rate is 8%

- This is a cost because for every $ invested with borrowed funds or retained funds, it could’ve been earning the interest rate too!

- Therefore, the user cost is $180 per cubic metre per year it should equal MPKf for maximizing profits

- profit maximization after considering taxes: (1 - tau)MPKf = uc

- divide both sides by 1- tau to get the “tax-adjusted user cost of capital”

- actual corporate taxes are on profit not revenues and investment is sometimes deductible

- depreciation allowances

- investment tax credit

- therefore use effective tax rate: what tax rate (tau), on revenue has the same effect as the actual tax code

q theory of investment

- James Tobin, Yale

- that stock prices influence capital investment

- if Tobin’s q > 1, profitable to acquire additional capital since value > cost

- if Tobin’s q < 1, not profitable

- Tobin’s q = V / pKK

- V: stock market value of firm, pKK is the replacement cost of the firm’s capital cost (Maintenance CAPEX?)

- Higher MPK → higher stock prices → higher q

- lower real interest rates → shift from investing in bonds to stocks → higher stock prices → higher q

- lower capital purchase price → lower denominator and higher q

Changes

- decrease in expected real interest rate, increases desired capital stock

- higher capital stock means higher profits meaning higher stock prices as well

- technological changes increase MPKf

Taxes

Effective tax rates on capital investment G7

| Country | 2005 | 2010 | 2015 |

|---|---|---|---|

| Canada | 38.8% | 19.9% | 20.0% |

| Germany | 33.8 | 24.3 | 23.8 |

| Italy | 32.5 | 27.2 | 8.3 |

| United States | 35.2 | 34.6 | 34.6 |

| United Kingdom | 29.7 | 28.7 | 22.9 |

| Japan | 45.8 | 45.8 | 42.1 |

Is Japan high post flattening of GDP or was it always high?

Two opposing forces: purchase or construction of new capital goods (gross investment)increases capital stock but capital stock does depreciate and wear out which reduces the capital stock. I feel that with software, tech debt does not actually wear until it becomes unbearable and unproductive to use and/or update. The difference between gross investment and depreciation is net investment.

net investment = gross investment - depreciation

Kt+t can be replaced with the desired capital (K*)

Realistically, the investment cannot be made immediately and might take years as in the case of skyscrapers and nuclear power plants.

Determinants of Desired Investment

| An increase in… | Causes Desired Investment to | Reason |

|---|---|---|

| Real interest rate, r | Fall | The user cost increases, which reduces desired capital stock. |

| Effective tax rate | Fall | The tax-adjusted user cost increases, which reduces desired capital stock. |

| Expected future MPK | Rise | The desired capital stock increases. |

Investment in Inventories and Housing

- Inventory investment = increase in inventory of unsold goods, unfinished goods, or raw materials

- the most volatile component of investment spending during business cycles

- Residential investment: construction of housing, (SFH, condos, apartments)

Why might inventory spending increase?

- add more variety (e.g., for cars) for shoppers to select from to avoid waiting for delivery

- The expected commission (keeping the same sales force) from the increase dictates the spending inventory level

- Cost of holding more inventory (cars): depreciation, financing for the higher inventory

Apartment investments:

- marginal product is the real value of rents (that can be collected) minus taxes and operating costs.

- the user costs = depreciation, wear and tear, and interest costs

- construction incentive: future marginal product is at least as great as its user cost

As for other types of capital, constructing an apartment building is profitable only if its expected future marginal product is at least as great as its user cost.

Goods Market Equilibrium

- what economics forces at play?

- real interest rate plays a big part

- equilibrium is when aggregate quantity of goods supplied equals aggregate quantity of goods demanded

- equilibrium is when Y = Cd + Id + G

- difference between income-expenditure identity is that there are two desired components, so actual output vs. desired may be different.

- Desired savings (Sd) = desired investment Id ; graph with interest rates being the vertical axis

- higher interest rates make investments more expensive as the competing rate of earning can be met in the bonds market or something

- There is some contradiction as now the text is claiming that higher real interest rates definitely increase national savings

- Apparently the real interest rate will be bid up. I guess because banks will have exhausted lending, so private credit lends at the equilibrium rate?

- The interest rate represents many rates so things get messy in real world

Shifts in the Savings Curve

- a temporary increase in government spending can result in savings curve shifting left (lower desired national savings)

- crowding out is when government spending (excess demand for resources) causes investment to decrease (due to the higher market-clearing interest rates)

- Apparently “expected increase in future income” does not shift the savings curve down

- net export crowding: if a fiscal expansion causes the local currency to appreciate, reducing the net exports.

Shifts in the Investment Curve

- new invention that increases MPK

- new economic reforms

Lesson 3 Summary

- Discuss the factors that underlie economy-wide demand for goods and services in a closed economy.

- Explain the determinants of household spending and saving.

- Explain the determinants of investment spending by firms.

- Describe how equilibrium is obtained in the goods market.

- Explain the role of the real interest rate in bringing goods market to equilibrium.

- Describe how equilibrium is obtained between saving and investment using the saving-investment diagram.

Chapter 7 - The Asset Market, Money, and Prices

Buy and sell financial assets such as gold, houses, stocks, and bonds

Money: assets that can be used to make payments, such as cash, and chequing accounts. Most prices are expressed in units of money.

What is Money?

- assets that are widely used and accepted as payment

- medium of exchange

- without money, bartering is done

- bartering flaw is that it is hard to find someone who has the item you have and is willing to trade it for what you have

- opportunity to specialize is greatly reduced

- without money, bartering is done

- unit of account

- uniform way to measure value of everything (naturally flowing from previous statement)

- not always the same as medium of exchange for countries with high and erratic inflation. WANT: currency stability

- store of value

- any asset could be a store of value

- money is held even with low return because it can be used as a medium of exchange

Measures of Money

- M1 + Monetary Aggregate

- Narrowly defined money

- Currency and Balances held in chequing accounts

- All of its components are accepted and used for payments

- 37.6M population so $2396/person

- does not include savings accounts

- M2

- M1+ plus somewhat less money-like comprise M2

- non-chequable deposits

- cheques cannot be written on these deposits

- Investment accounts

- M3

- GIC accounts (fixed deposits)

- non-personal term deposits

- FX deposits of residents (because they can be easily converted to usable currency)

The Money Supply

- amount of money in the economy

- partly determined by the central bank

- open-market operations

- open-market purchase: newly minted currency buys financial assets such as government bonds from the public

- open-market sale: sell government bonds to reduce money supply

- can also purchase bonds directly from the government (printing money)

- developing countries with low tax base

- racked by war or natural disaster (government spending is necessary to prevent loss of life, not the same as not welfare)

- BoC is treated as a private entity (independent) which is why national savings still decreases with government deficits

Portfolio Allocation

- which assets and how much of each asset to hold

- Expected Return

- the higher an asset’s expected return (after subtracting taxes and fees such as brokers’ commissions), the more desirable the asset is and the more of it holders of wealth will want to own

- Risk

- Uncertainty about the return an asset will earn

- Most people don’t like risk

- Liquidity

- A liquid asset can easily be disposed of if there is an emergency need for funds or if an unexpectedly good financial investment opportunity arises. Thus, everything else being equal, the more liquid an asset is, the more attractive it will be to holders of wealth.

- Time to Maturity

- amount of time until a financial security matures

- prefer shorter over longer

- expectations theory means average of short terms = long

- reality: longer = higher returns due to term premium

Types of Assets

-

Bonds

- Fixed-income securities

- Canadian bonds have very low risk of default. High liquidity

- Corporate bonds are higher risk and could be illiquid during troubling times -Stocks

- Corporate ownership

- Dividends

- Small businesses are owned by one or two people and its shares are not marketable

- Return is profits or selling the company

-

Houses

- Largest asset for most homeowners

- Benefit of shelter minus maintenance and property taxes

- Change in value of the land and the house

- Mistaken belief that there is no risk in holding wealth as housing. US Housing Crisis

- Very illiquid, could take months or years to sell BUT home equity line of credit (HELOC) is available

- Durable goods such as automobiles, furniture, and appliances

-

The demand for each asset is how much a holder of wealth allocated for it in their portfolio

-

US housing crisis: less regulation in the US led to 22% of all mortgages being sub-prime, combined with delayed interest rising resulted in delayed mass default (52% in Freddie Mac and Fannie Mae)

-

Mortgage Backed Securities containing these loans were sold to everyone even foreign investors meaning that that the collapse affected more than just the USA

Demand for Money

- Liquid and low return

- Factors:

- higher price level → proportional demand for more money

- 70 years ago, price levels was 1/10th meaning nominally, you’d need 10 times less money.

- higher real income → demand more money (real means implies more money)

- higher real income means more spending meaning more liquidity needed

- not proportional, as higher the income, more efficient investment (might require minimum balance)

- also lower the income, there might not just be as many attractive alternatives

- increase in interest rates on monetary assets compared to non-monetary assets → demand more money

- returns on alternative assets can sway the demand for money

- a decrease in interest rates for non-monetary assets increases demand for money

- higher price level → proportional demand for more money

- Other Factors

- Increase in Wealth, small increase in demand for money

- Higher risk in alternative assets increases demand for money. Money itself can be risky via erratic inflation.

- Liquidity in other assets will reduce demand for money

- Convertibility to cash (deregulation, competition, innovation in financial markets)

- Efficiency in payment tech will reduce demand for money

- Credit cards, ATMs, debit cards

- Md = aggregate demand for money, in nominal terms

- P = the price level

- Y = real income or output

- i = the nominal interest rate earned by alternative, non-monetary assets (e.g. bonds)

- L =a function relating money demand to real income and the nominal interest rate

- the interest on monetary assets is less volatile than the interest on non-monetary assets and is thus not statistically included

- Can also use r + pi^e to express in terms of real interest and expected inflation rate

Divide both sides by the price level to get the real demand for money. Also known as the money demand function

Elasticities of Money Demand

- income elasticity of money demand: increase in money demanded for 1% increase in real income. suggested to be 0.5

- interest elasticity of money demand: increase in money demanded for 1% increase in interest rates on non-monetary assets (NOT PERCENTAGE POINTS. THINK 0.10 to 0.101). suggested to be -0.3

- inflation decreases as demand for money increases

Velocity and Quantity Theory of Money

- Turn over of the money stock

- nominal GDP / nominal money stock

- real income / real money demand

- higher velocity means each dollar is being used in a greater dollar volume of transactions (assuming transaction volume is proportional to gdp)

- quantity theory of money: real money demand is proportional to real income Md / P =kY where k is a constant

- demand for M reduces velocity so innovations such as interest bearing chequing accounts can reduce the velocity

- M1 velocity has been declining over time

- M2 is long-term stable but not over short-term due to something like the stock market

- % Change in velocity = % Change in Real Income minus Inflation minus % Change in Money Supply

Asset Market Equilibrium

- each asset has a fixed-supply, so equilibrium is met when the quantity demanded for each asset equals the fixed supply

- linked to the price level

- Two groups: money (M = all assets that can be used for payments. assumed to pay im). non-monetary (NM) assets pay (expected real interest rate + expected inflation rate)

- Md (total money desired by everyone) + NMd (desired non-monetary assets) = aggregate nominal wealth (as in the sum of desired distribution of wealth = total aggregate wealth)

- M + NM = aggregate nominal wealth (wealth = the two components that make it up)

- Therefore, there is equilibrium when the quantity of money demanded equals the quantity of money supplied

- The nominal money supply M is determined by the central bank through its open-market operations

- any imbalance between desired national saving and desired national investment is bridged by foreign borrowing or foreign lending

- Price factor is nominal money divided by the real demand for money

- Under classic model, government spending increases price levels which means that output does not increase

- If the expected inflation rate decreases, there is lower demand for non-monetary assets (due to lower nominal rates) and thus a higher demand for money

Money Growth and Inflation

The growth in price levels (inflation) is closely linked to the growth in the nominal money supply.

- the rate of inflation equals the growth rate of the nominal money supply minus the growth rate of real money demand

With ηY (\eta_Y) being the income elasticity of money demand, then in the long run where nominal interest rates are constant, inflation can be stated as:

Suppose that nominal money supply growth is 10% per year, real income is growing by 3% per year, and the income elasticity of money demand is 2/3. Then, Eq. (7.12) predicts that the inflation rate will be 10% − (2/3)(3%), or 8% per year.

By subtracting the variable nominal yield on the real return bond from the fixed nominal yield on the conventional bond, the Bank can therefore obtain a measure of inflation expectations.

Learning Outcomes

- List the functions of money.

- Discuss the different measures of the money and how they relate to the money supply.

- Explain the factors affecting how people allocate their wealth among various assets.

- Discuss the key macroeconomic variables that affect money demand.

- List the variables in the nominal money demand function and explain the effects of changes in each variable.

- Explain how changes in the real interest rate and expected inflation affect nominal money demand.

- Describe how the real money demand equation is obtained.

- Explain how other factors affect money demand.

- Define and calculate elasticities of money demand.

- Explain velocity.

- Discuss the quantity theory of money.

- Describe how equilibrium is obtained in the asset market.

- Discuss how the money supply is related to the rate of inflation.

Chapter 5 - Saving and Investment in the Open Economy

- open economies mean countries can temporarily spend more than they produce (via imports)

- desired investment does not have to equal desired saving when foreign sector is involved

- When saving > investment, lend in international market (current account surplus). When saving < investment, international borrower (current account deficit)

- The current account indicates how much is available for net foreign lending

- It is essentially the net payments/income transferred from and to

Balance of Payments

- Current account has three separate components

- net exports of goods and services

- merchandise trade balance = merchandise exports - merchandise imports

- gets more attention in press than warranted

- services include tourism

- foreign students in canada are an export of services

- merchandise trade balance = merchandise exports - merchandise imports

- investment income from assets abroad

- interest payments, dividends, royalties (credit)

- payment of investment income is a debit

- NFP include this plus the wages & salaries of Canadians working abroad but it’s small enough to ignore…

- current transfers

- payments from one country to the other (e.g. foreign aid)

- current account balance

- add all credit items and subtract all debit items in the current account

- positive = current account surplus, negative = current account deficit

- net exports of goods and services

Capital Account = inflows - outflows

- When the capital account has a surplus, that means that the net foreign assets decrease because there was more inflows (purchases of domestic assets) than outflows (purchases of foreign assets)

- Transactions where the good being purchased was not currently produced won’t be included in the current account. Trade of existing assets is recorded in the capital and financial account. When domestic assets are sold to foreigners, it’s a financial inflow (credit) since funds are flowing into Canada.

Official Settlements Balance

- Official reserve assets (not domestic assets, foreign government securities, foreign bank deposits, IMF assets)

- balance of payments or official settlements balance is the net increase in a countries net holdings of reserve assets. Surplus when holdings increase and deficit when holding reduce.

Current Account Balance + Capital Account Balance = 0

- Reasoning: international transactions are swap of goods, services, or assets

- Suppose Canadian imports 75 CAD worth of goods from British exporter

- The exporter then purchases 75 CAD worth of pound sterlings from the FX market

- The purchase of the 75 CAD counts as a capital inflow (example is the central bank reducing its reserve currency)

- Not sure if FX Market counts as a capital inflow

- The purchase of the 75 CAD counts as a capital inflow (example is the central bank reducing its reserve currency)

- Statistical discrepancy when difference is non-zero

Net Foreign Assets and the Balance of Payments Accounts

- re-definition: net foreign assets: foreign stocks, bonds, and factories owned by domestic residents minus foreign liabilities (domestic assets owned by foreigners)

- changes: value of existing foreign assets and liabilities. acquisition of new foreign assets or liabilities

- net amount of acquisition is the current account surplus

- a deficit means selling of assets or acquiring more debt (net foreign borrowing)

If new capital bought with foreign debt is highly productive, the foreign debt would not be an economic burden.

Open Economy Goods Market Equilibrium

How to calculate savings: Investment plus current account (NX + NFP); CA = GDP - Investment - Consumption - Government

- In a closed-economy, CA = 0

- NFP determined by past investments so are not much affected by current macro-economic developments. Therefore, just look at net exports.

- Total spending by domestic residents is called absorption

- Y - National Saving?

Saving and Investment in a Small Open Economy

- a small economy cannot impact world real interest rate. Therefore the real interest rate is fixed

- a supply shock can cause savings to decrease and thus the current account surplus falls (if rates are low enough, then the current account deficit increases)

- a supply shock won’t impact investment since interest rates did not increase

- globalization

- Globalization in Canada: direct investment (influence management) vs. portfolio investment

Saving and Investment in Large Open Economies

- can affect real world interest rates

- domestic economy and foreign economy (rest of the world)

- the excess savings in the domestic market show up as the desired borrowing (foreign investment minus foreign saving) in the foreign economy

- the world real interest rate will be such that desired international lending by one country equals desired international borrowing by the other country

- The current account of the lender country rises (income receives from abroad)

- The sum of current accounts of all countries equals 0 (therefore, equilibrium is one big a system of linear equations)

Twin Deficits

- large government budget deficits and large current account deficits

- proposition: government deficit reduces desired national saving and thus reduces current account surplus (reduces capital outflows)

- A deficit due to higher government spending does reduce desired savings and thus also reduces the current account balance

- public savings decreases, so unless consumption decreases, national savings goes down

- A deficit due to tax cuts (meaning no reduction in spending) will increase consumption if the Ricardian equivalence does not hold

- The one thing to note is that in the long run, tax cuts without a reduction in government spending might end up hurting the national wealth as the interest paid by the government won’t be going to all Canadians

- Would require an increase in private saving, a decline in investment to offset, or a rise in current account deficit

- A decline in investment is unlikely as the government is either demanding more domestic goods or demand is maintained

- 100% saving is not possible due to the Marginal propensity to consume (MPC) which is ???

- A decline in investment is unlikely as the government is either demanding more domestic goods or demand is maintained

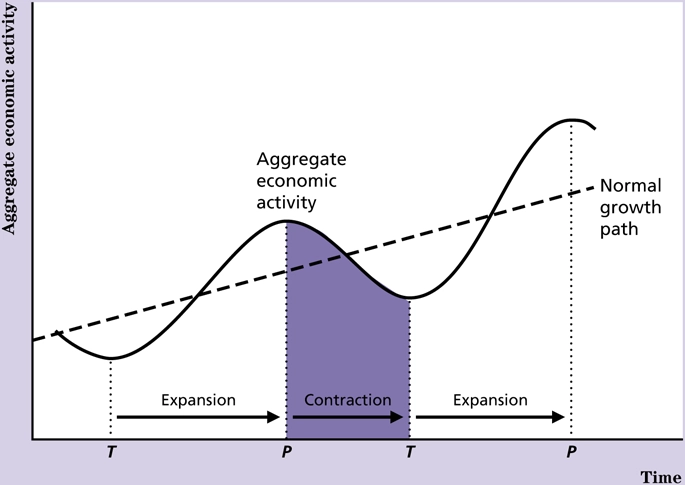

Chapter 8 - Business Cycles

What is a Business Cycle

A trough is the low point in a business cycle and a peak is the high point.

A severe recession is called a depression. Sequence from one peak to the next is called the business cycle. Properties include:

- Fluctuations of aggregate economic activity

- Feature expansions and contractions

- Persistent

History shows that business cycles have become less severe, attributed somewhat to better monetary policies, but it could simply be better measurements, more job variability, or a lot of things. There’s no proof that all these factors will always be there, especially when some countries are not appealing to live in (e.g. UK).

Business cycles are periodic (bound to happen) but not known when to happen or the interval for it (not recurrent)

Economic Variables and the Business Cycle

economic variables can be:

- procyclical: moves with the business cycle

- countercyclical: moves against the business cycle

- acyclical: does not depend on business cycle

comovement: many economic variables having regular and predictable patterns over the business cycle

timing:

- leading: occurs ahead of of aggregate economic activity

- coincident: occurs at the same time

- lagging: occurs behind economic activity

Key variables

- production (procyclical and coincident)

- expenditure (procyclical and coincident)

- labour market variables (employment is procyclical and coincident; opposite for unemployment)

- money growth (procyclical and leads the business cycle)

- meaning: high money growth comes before business cycle expansion and lower money growth comes before contraction. Could also be counter-cyclical since Bank of Canada is trying to influence the economy

- CPI inflation is procyclical but lags

- financial variables (e.g. stock prices are procyclical and lead the business cycle)

- lead is like 1 month, so losses in stock market are followed by contractions?

- Durables vs. nondurables

- can put off purchases of durable goods when times are tough

- Output is more volatile than total hours

Explanation of Fluctuation

- economic shocks and models related to it

- classical or keynesian approach via AD-AS framework

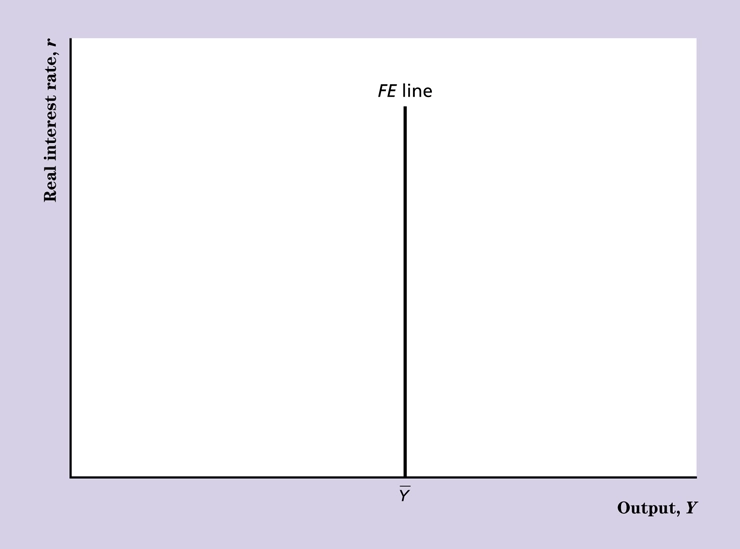

Chapter 9 - IS-LM-FE Model

Full Equilibrium

- for the classical theory, full equilibrium (FE) condition which relaxes the Keynesian assumption of fixed wages in the labour market

- A situation in which all markets in an economy are simultaneously in equilibrium is called a general equilibrium

The full-employment line shifts right/left because of:

| All Else Equal, An | Shifts the FE line | Reason |

|---|---|---|

| Beneficial supply shock | Right | 1.More output can be produced for the same amount of capital and labour. 2. If the MPN rises, labour demand increases and raises employment. Full-employment output increases for both reasons. |

| Increase in labour supply | Right | Equilibrium employment rises, raising full-employment output. |

| Increase in the capital stock | Right | More output can be produced with the same amount of labour. In addition, increased capital may increase the MPN, which increases labour demand and equilibrium employment. |

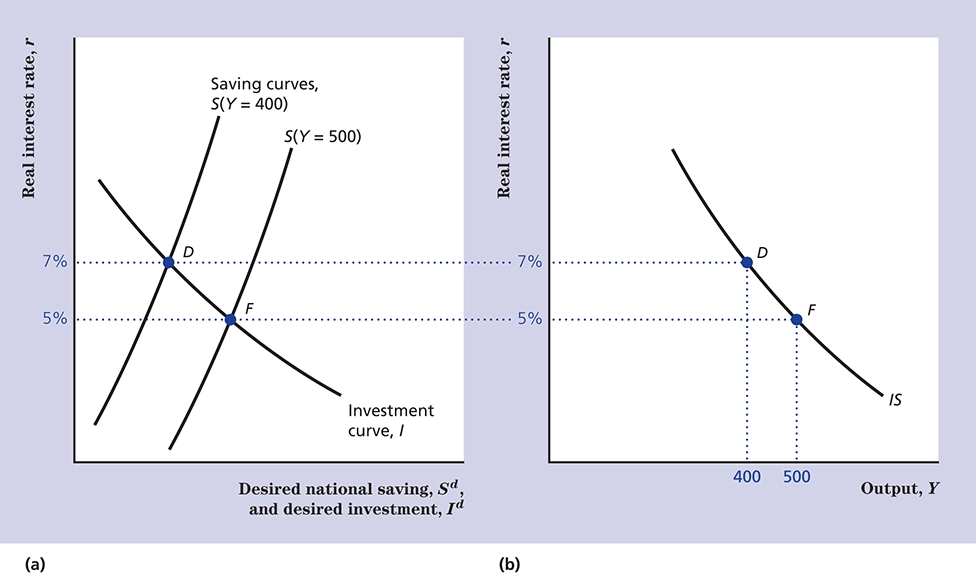

Investment-Saving Curve

- Investment-Saving

- Savings and Investment equilibrium = goods market equilibrium

Factors That Shift the IS Curve

| All Else Equal, an Increase in | Shifts the IS Curve | Reason |

|---|---|---|

| Expected future output | Up and to the right | Desired consumption rises, raising the real interest rate that clears the goods market. |

| Wealth | Up and to the right | Desired saving falls (desired consumption rises), raising the real interest rate that clears the goods market. |

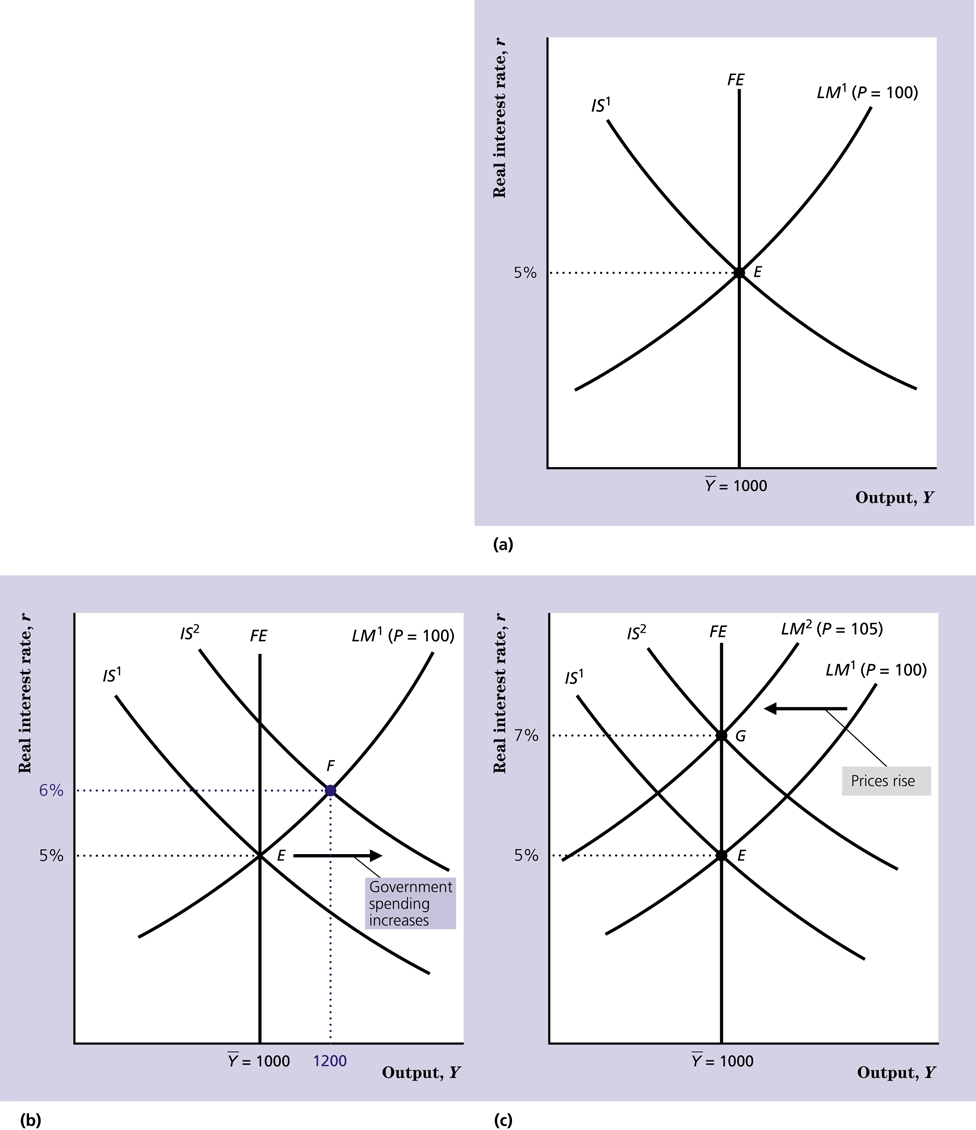

| Government purchases, G | Up and to the right | Desired saving falls (demand for goods rises), raising the real interest rate that clears the goods market. |

| Taxes, T | No change or down and to the left | No change, if consumers take into account an offsetting future tax cut and do not change consumption (Ricardian equivalence); down, if consumers do not take into account a future tax cut and reduce desired consumption, increasing desired national saving and lowering the real interest rate that clears the goods market. |

| Expected future marginal product of capital, MPKf | Up and to the right | Desired investment increases, raising the real interest rate that clears the goods market. |

| Effective tax rate on capital | Down and to the left | Desired investment falls, lowering the real interest rate that clears the goods market. |

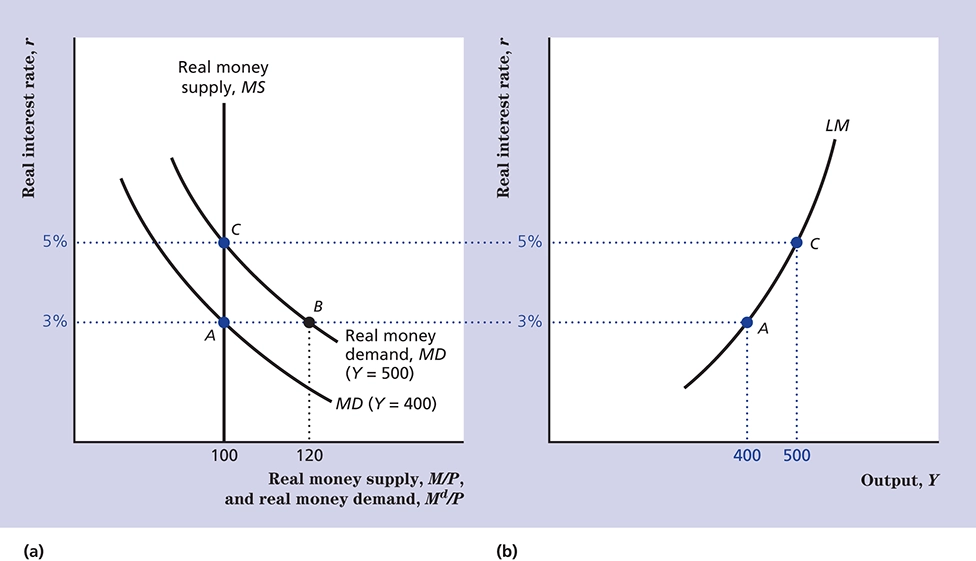

Liquidity-Money Curve

- Price of non-monetary assets is inversely related to its nominal interest rate or yield

- For a given rate of inflation, the price of a non-monetary asset and its real interest rate are also inversely related

Basically, higher the price, lower the real interest rate. There is a different MD curve for each output Y.

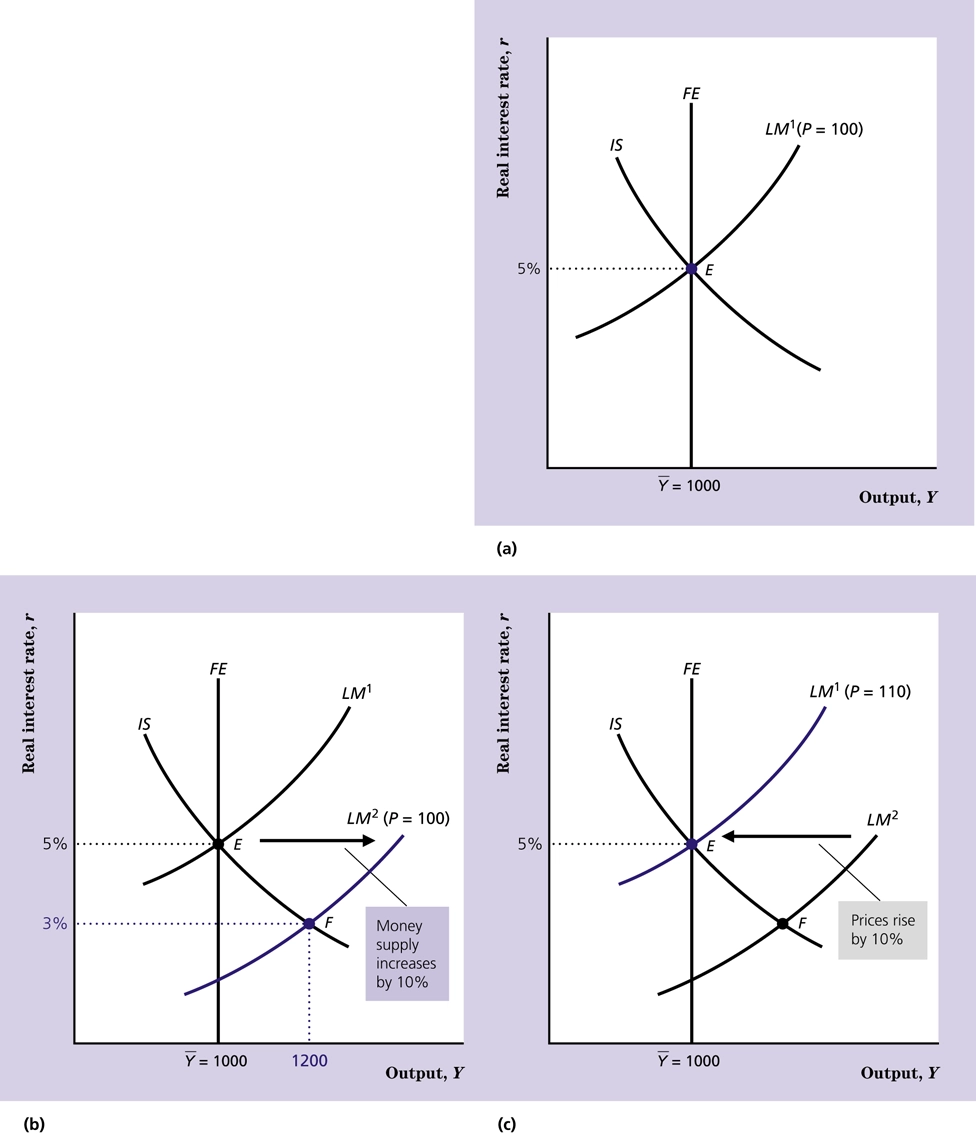

| All Else Equal, an Increase in | Shifts the LM Curve | Reason |

|---|---|---|

| Nominal money supply, M | Down-right | Real money supply increases, lowering the real interest rate |

| Price level, P | Up-left | Real money supply falls, raising real interest rate that clears the asset market |

| Expected inflation, pie | Down-right | Demand for money falls, lowering the real interest rate that clears the asset market |

| Nominal interest rate on money, im | Up-left | Demand for money increases, raising the real interest rate that clears the asset market |

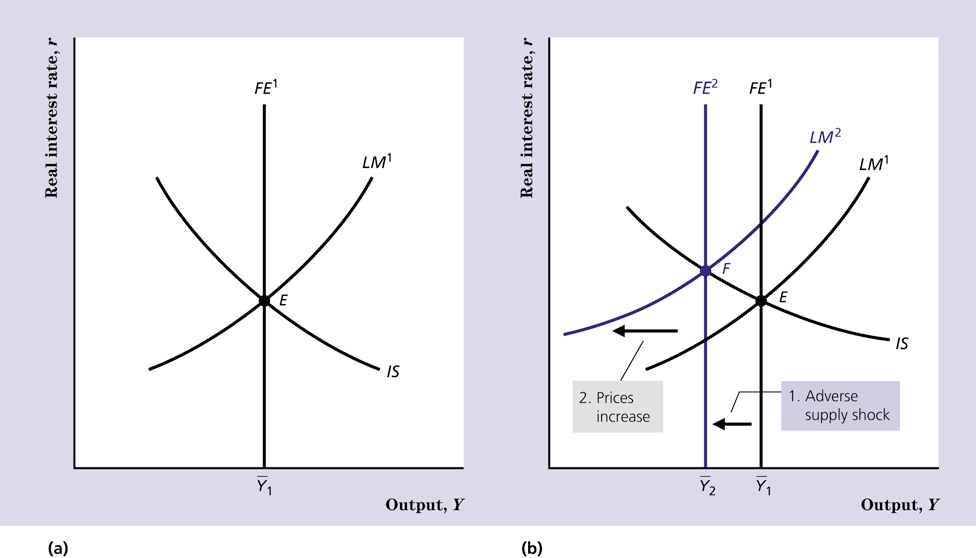

Temporary Adverse Supply Shock

- Productivity falls temporarily,

- FE shifts left

- Price level adjust since IS and LS have a gap

- Real wage, employment, and output decline; real interest rate and price level at higher equilibrium point

- temporary inflation (higher price level)

- consumption and investment are lower

What is not consistent is that the real interest rate might not increase due to mismatched expectations; apparently if the shock is expected to be permanent, rates would not rise; the lesson says the shock was temporary, but historic oil prices shows that the oil prices stayed steady after 1974 till the next shock, whereas oil prices decreased after 1980. Real interest rates only rise if the expectation is that it is temporary.

1973-1974 Oil shock: USA gave $2.2B to Israel and OAPEC (OPEC Arab countries) decided to have an oil embargo on the USA. It is pretty clear that people would think this shock would be permanent. It’s not really clear why oil prices remained high even after the embargo ended in 1974. Prices most likely remained the same due to the devaluation of the USD by that time.

Constant: Government spending and nominal money supply

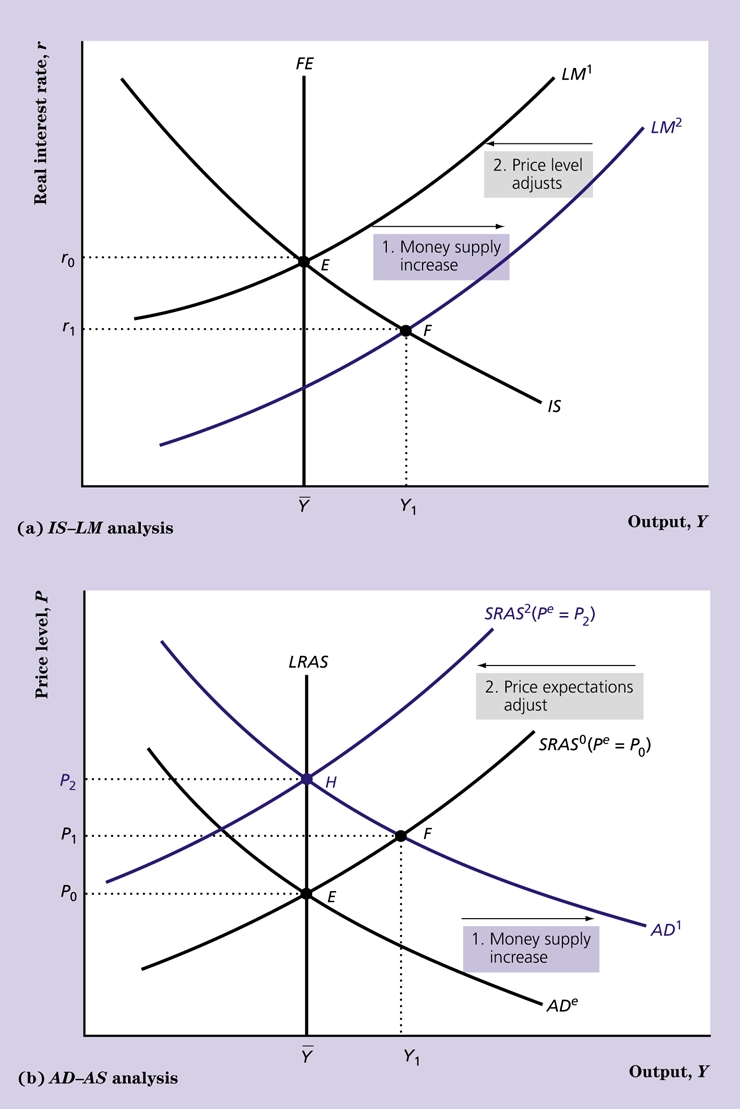

Monetary Expansion

- short-term: lower interest rates and higher demand for output

- long-term: prices get higher but no net difference

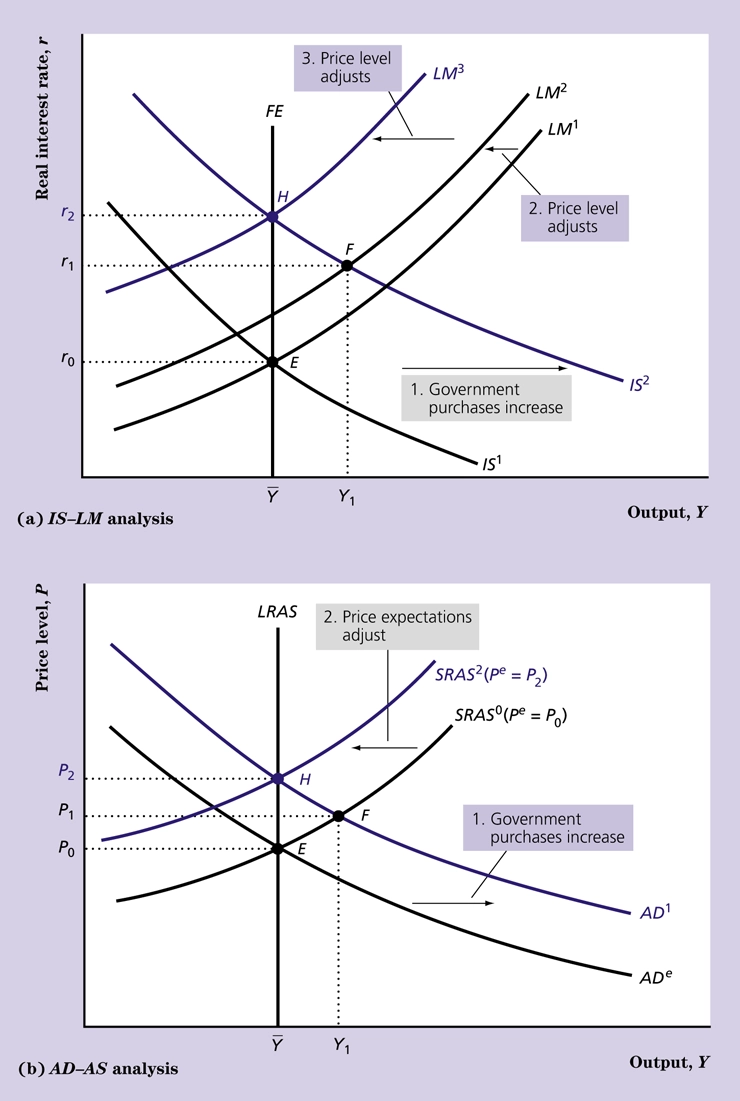

Fiscal Expansion

- government increases spending

- short-term: higher IS curve so higher interest rates

- long-term: prices and interest rates are higher

IS-LM-FE Classical vs Keynesian

- how rapidly is general equilibrium reached (could be 3 years in reality)

- what does monetary policy do?

- classical believes monetary neutrality exists in short-run whereas Keynesian only believes in long-run.

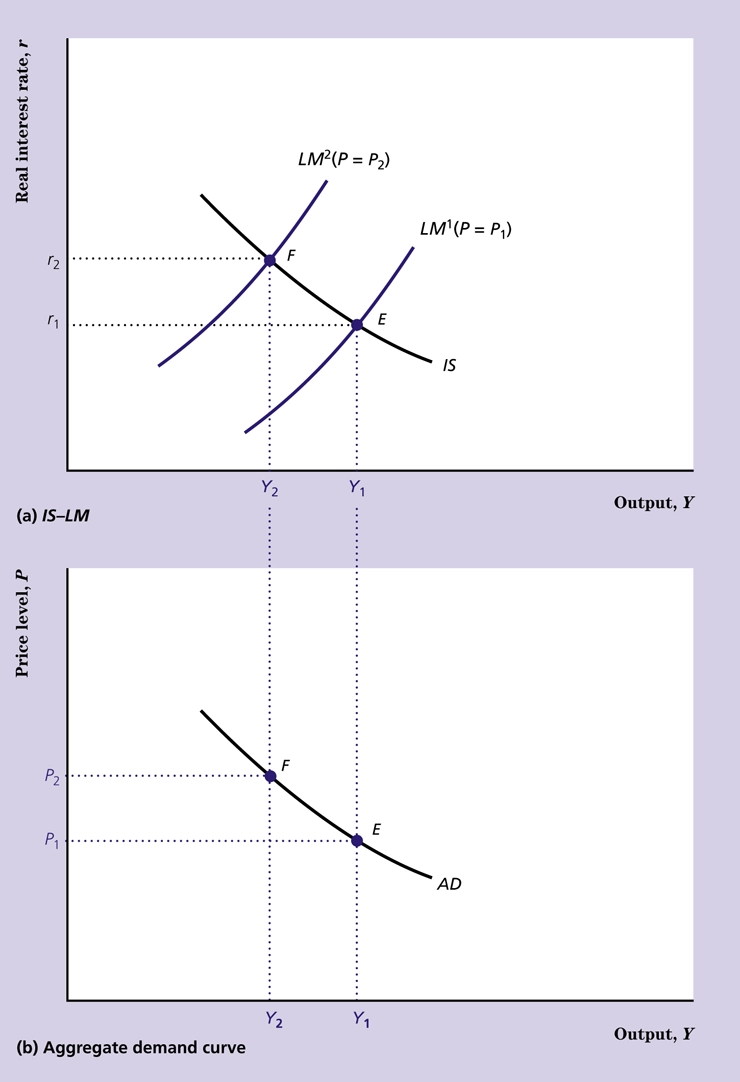

Aggregate Demand Curve

The relationship between price levels and output

Factors that shift the curve is when the IS or LM shift while keeping the price level constant.

Chapter 9 Quiz Questions

Suppose the aggregate demand curve is given by the equation: Y =540 +30M/P.

The full-employment level of output is 1,500 and the current nominal money supply is 15. If the economy is in full-employment equilibrium, calculate the current price level.

P = enter your response here

With the price level fixed at 0.469, suppose the nominal money supply changes by 3 and is now 18.

Now find the short-run equilibrium level of output.

Y = enter your response here

To return to long-run equilibrium, the price level must adjust, shifting the short-run aggregate supply curve. The long-run equilibrium price level is:

P = enter your response here

Chapter 10 - Exchange Rates, Business Cycles, and Macroeconomic Policy in the Open Economy

Nation economies are interdependent in two main ways meaning policies of one country can affect the other

- International trade in goods and service

- Worldwide integration of financial markets

Nominal Exchange Rates

- Units of foreign currency that can be purchased with one unit of domestic currency.

- for most major currencies, enom is floating

- Canadian Effective Exchange Rate index (CEER) of 17 largest trading partners but moves in tandem with CA-US exchange rate

- Relative purchasing power parity: nominal rates change with inflation

Real Exchange Rates

- price of domestic goods relative to foreign goods such that

- if one hamburger in Japan costs 312 yen and one hamburger in Canada costs 3 dollars then the real exchange rate is 78 yen per Canadian dollar

Appreciation and Depreciation

- When the domestic currency appreciation: nominal exchange rate rises (buy more foreign currency)

- When the domestic currency nominal depreciation: nominal exchange rate falls (buy less foreign currency)

- fixed: weakening of the currency is called a devaluation while a strengthening is called a revaluation

Purchasing Power Parity

- holds in long run but not in the short run:

- countries produce different goods

- some goods aren’t traded

- transportation costs and legal barriers to trade

First factor is the appreciation and the last two factors are the inflation rates

Therefore, a nominal appreciation is either due to a real appreciation or a lower domestic inflation rate

Real Exchange Rate and Net Exports

This implies that the higher the real exchange rate, the lower a country’s net exports will be.

Demand for Currency

- able to buy goods from countries using said currency

- able to purchase real and financial assets denominated in said currency

Supply for Currency

- buy foreign goods

- buy foreign real and financial assets

Currency and Changes in Output (Income)

Rise in domestic output also meaning higher imports and lower net exports. Exchange rate decreases because they need to purchase foreign currency,

Effects of Change in Real Interest Rates

A rise in domestic interest rates makes foreigners want to buy domestic assets and strengthens the exchange rate

Returns on Domestic and Foreign Assets

Nominal rate of return on a foreign bond:

Interest Rate Parity

Suggests that there is an indifference between domestic and foreign assets of comparable risk and liquidity;

IS-LM-FE and Net Exports

- factors that increase net exports shift the IS curve up

- factors that decrease net exports shift the IS curve down

Factors that shift

- an increase in foreign output, which increases foreigners’ demand for domestic exports;

- an increase in the foreign real interest rate, which makes people want to buy foreign assets, causing the exchange rate to depreciate, which in turn causes net exports to rise;

- a shift in worldwide demand toward the domestic country’s goods, such as an increase in the relative quality of the domestic good

International Transmission of Business Cycles

- US output decline reduces demand for Canadian exports, shifting Canadian IS curve down

- therefore recession in Canada in a Keynesian model but in classical there is not affect

Mundell-Fleming Model

- small open economy IS-LM model which assumes that the exchange rate is not expected to change

- policies won’t affect foreign interest rates

Fiscal Expansion and Interest Rates

A rise in government purchases shifts the IS curve up and the domestic interest rate temporarily rises which induces capital inflows, appreciating the domestic currency, and thus making expert more expensive, such that IS curve shifts left until the domestic interest rate equals the foreign rate.

Monetary Expansion and Interest Rates

An increase in domestic money supply shifts the LM down, causing the domestic interest rate to fall below the foreign rate. Arbitrage opportunities induce capital flow into foreign from domestic, depreciating the domestic currency. A depreciated currency makes net exports cheaper, shifting the IS curve to teh right. The end result, assuming a fixed price-level, is an equal interest rate, depreciated currency, and higher net exports.

In the long-run, keynesian model shows monetary neutrality which occurs immediately for the Classic model; real exchange rate unaffected but nominal exchange rate is affected.

Fixed Exchange Rates

The nominal exchange rate is official set by the government, possibly in agreement with other countries. If the fundamental rate, determined by free market participants is less than the official rate, then the currency is overvalued. Responses include:

- The country can devalue the currency (by reducing the exchange rate) but if it did this a lot, it might as well employ a flexible-rate system.

- The country could also restrict international transactions to reduce the supply of its currency to the foreign exchange market, thus raising the fundamental value; even though this is suppression.

- Country could purchase its own currency via the central banks official reserve assets (gold, foreign bank deposits, and special assets created by agencies like the IMF). Reserve assets = balance of payments deficit. This method has its limits since some countries ran out of gold and thus a currency devaluation was inevitable.

- Similarly, an undervalued currency can’t be maintained for long by foreign central banks

- An undervalued currency can also be responded to by increasing the money supply

Monetary Policy and Fixed Exchange Rate